Leaving a legacy is a powerful thing. While we aim to be remembered for how we treated others during our lifetime, too many stimuli pull our contemporaries’ attention in other directions, making it easy for those to overlook the good we’ve done. However, what if we could continue our generosity and kind spirit years after we’ve passed? Planned and Legacy giving — charitable donations after a donor’s life through wills, bequests, beneficiary designations and more — is a way to create a lasting legacy of support that continues long after we’ve left this world.

Planned gifts ensure a foundation of future funding, and as these donations are typically some of the largest a nonprofit will receive, the organization sees a significant, immediate and (if the donation is distributed over an extended period of time, as is often the case) long-lasting impact. Income from Planned/Legacy gifts makes it much easier to set budgets and meet operational commitments. Nonprofits with robust Planned/Legacy giving programs can more easily thrive in stable economic times, and better adapt when times are leaner.

Legacy gifts can take many forms, with the most common being wills, trusts, gift intent forms, beneficiary designations, bequests, life insurance policies, real estate, equity and business interests. Read on to learn more….

PLANNED/LEGACY GIVING: AN UNDERUTILIZED REVENUE STREAM

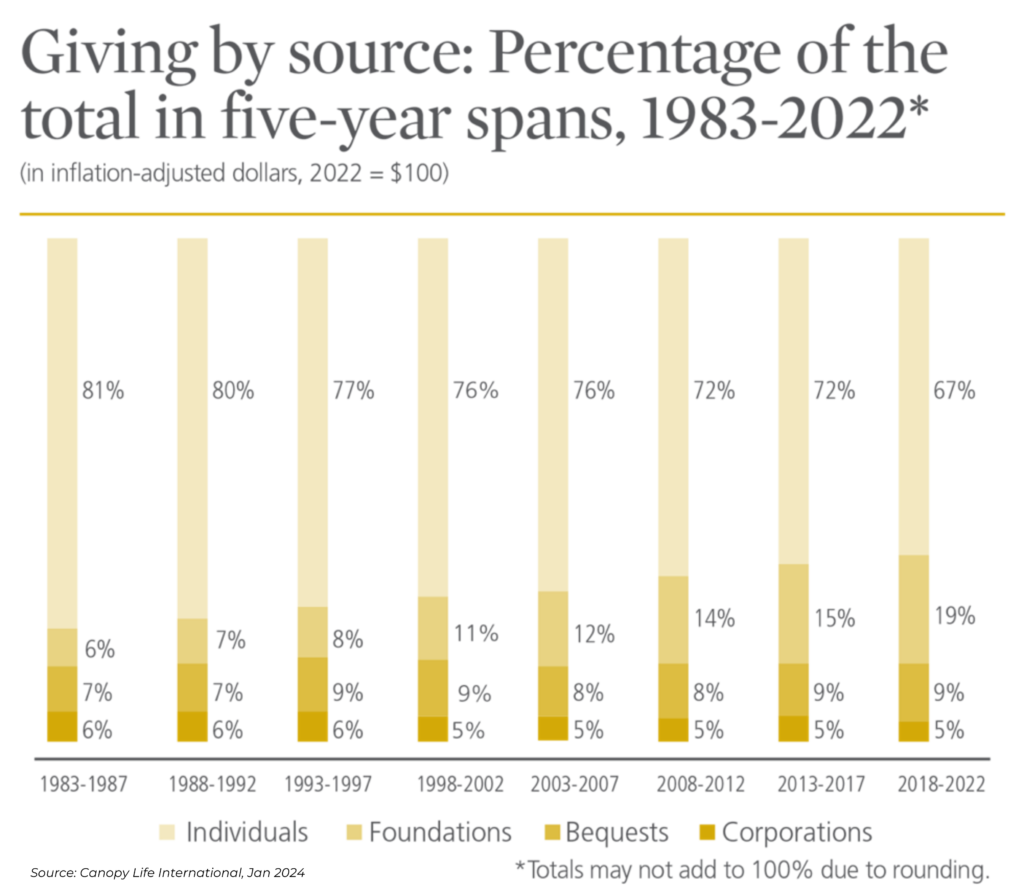

According to CCS Gift Planning Practice Group‘s 2024 State of Planned Giving in Fundraising, Planned/Legacy gifts totaled only 16% of overall fundraising, and only 11% of campaigns. And some fundraising pundits place that estimate much lower — including a 20-year planned fundraising professional who thinks that less than 1% of nonprofits take planned giving seriously.

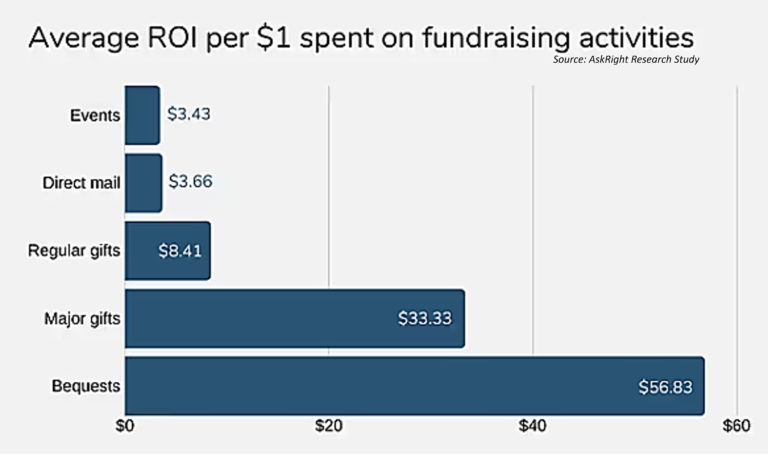

One benefit of Planned/Legacy Giving is the minimal administrative costs associated with most gifts. Because there is typically very little ‘red tape’ to work through for such donations, Planned Giving boasts the highest ROI of all major fundraising categories, including Individual gifts, Corporate donations, Foundation giving, Events and in-kind gifts. Additionally, several industry studies have shown that Planned giving does not cannibalize individual annual gifts; in fact, it has been shown to boost annual giving by as much as 50%.

PLANNED GIVING REACHES AN UPPER ECHELON OF DONORS

Although the number of U.S. households owning stock either through individual shares, mutual funds or retirement accounts hit a new high in 2022, that total only hit 58% — meaning more than 42% of the population likely does not have much (if any) disposable income to donate.

Planned/Legacy giving helps organizations uncover high-affinity donors — who do have investment accounts. This economic demographic has the greatest amount of disposable income, making them the singularly most compelling group in the donor audience. And as nonprofits know, it’s the higher-affinity donors who tend to donate more sizeable gifts. In the 80/20 rule of ‘80% of revenues come from 20% of donors,’ Planned/Legacy supporters most certainly reside in that 20% group.

DONORS CAN MAKE A DIFFERENCE BEYOND THEIR LIFETIMES…AND AT A VALUE THAT INCREASES

One of the most meaningful gifts is one that helps an organization’s work perpetually. A Legacy/Planned donation can help fund positive outcomes long after the donor’s life span, strengthening the donor’s support and legacy. In addition, a gift of unliquidated stock, mutual funds or similar growth fund can, if the market grows, increase by as much as 10-15% every year commensurate with the market — even in the face of a recession or other economic decline.

Because of the size, options and maturity growth of these gifts, the ROI-per-dollar is higher than just about any other form of charitable giving. Planned gifts traditionally have a higher dollar value than individual or major gifts in part because they can come from a variety of sources which usually cannot be liquidated during the donor’s lifetime (more on those options below). For most donors, charitable gift amounts are usually derived as a certain percentage of their annual income. However, Planned/Legacy gifts are typically gifts of assets — from their retirement, life insurance payout, proceeds from a house sale, etc. — which have built up over decades, and therefore are generally much greater in value than any other donation.

By making a Planned/Legacy gift, donors ensure a legacy of generosity that will outlive them, and the nonprofits they support secure enduring long-term financial support to sustain their mission.

A PLANNED/LEGACY GIFT DOESN’T AFFECT A DONOR’S CURRENT FINANCES

TAX ADVANTAGES OF PLANNED/LEGACY GIVING

If you’d like to talk about where your Planned & Legacy program currently sits — and how you can make it more predominant within your Giving plan, please drop us a line!